Maßgeschneiderte Fuhrparkberatung

Optimieren Sie Ihren Fuhrpark gemeinsam mit unseren Experten

Wir begleiten Sie beim Mobilitätswandel auf dem Weg zu einer optimierten Flotte. Um Ihnen dauerhaft optimale Lösungen für Ihr Flottenmanagement liefern zu können, erweitern wir unser Beratungsangebot stetig. Die persönliche Fuhrparkbetreuung ist und bleibt dabei der wesentliche Bestandteil unseres Service-Pakets.

Mit dem Beratungsangebot Arval Mobility Consulting helfen wir Ihnen dabei, Mobilitätsrichtlinien zu entwickeln, die sich sowohl an den Nachhaltigkeitszielen Ihres Unternehmens als auch an den Bedürfnissen Ihrer Flottenfahrenden orientieren.

Mit Hilfe unserer intelligenten Fuhrparkanalyse machen wir die Leistungsfähigkeit Ihres Fuhrparks messbar. Zudem beraten Sie unsere Fuhrpark-Spezialisten bei der Formulierung der Dienstwagen-CarPolicy und allen Aspekten der Fuhrpark-Verwaltung.

Dank verbesserter Service-Leistungen und Fleet Management Tools erleichtern wir Ihnen die Arbeit. Ziel ist es dabei immer, die Kosten für Ihren Fuhrpark zu senken.

Nachhaltigkeit auf ganzer Linie: Von A wie Antrieb bis Z wie Ziele

Unsere Fuhrparkberaterinnen und Fuhrparkberater begleiten Sie während der Transformation: Beginnend mit der Analyse und der Planung Ihrer Nachhaltigkeitsziele über die konkrete Umsetzung bis hin zur stetigen Weiterentwicklung und der Suche nach zukünftigen Mobilitätslösungen – wir sind in allen Belangen Ihre Ansprechperson.

Mögliche Schwerpunkte, die in die Fuhrparkberatung mit einfließen:

- Innovative Antriebslösungen wie Hybrid und Elektro

- Integration von CSR-Zielen in die Flottenstrategie

- Alternative Mobilitätslösungen wie Bike Leasing

- Einsatz von Telematiklösungen

Unterwegs zur nachhaltigen Flotte mit der Arval SMaRT Fuhrparkanalyse

Mit SMaRT gestalten Sie den Energiewandel mit und leisten einen Beitrag zur nachhaltigen Entwicklung der globalen Mobilität. Dank der, 2018 von Arval entwickelten, innovativen SMaRT-Methode („Sustainable Mobility and Responsibility Targets“) helfen wir Ihnen aktiv dabei, Ihren Beitrag zum Umweltschutz zu leisten.

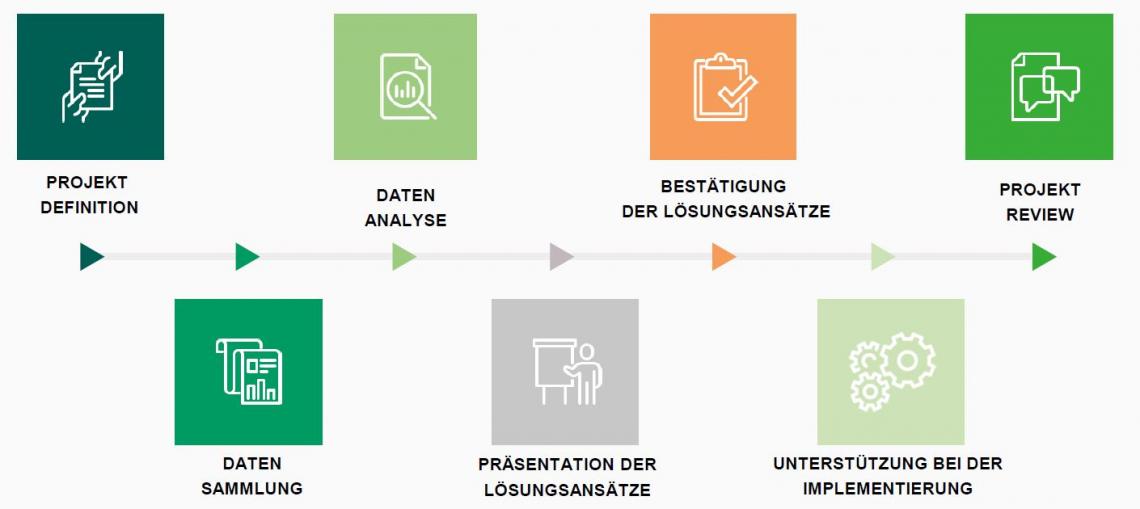

Das Arval Mobility Consulting besteht zusammengefasst aus drei Phasen:

1. Formulierung von Unternehmenszielen zur nachhaltigen Mobilität

Unsere Consultants definieren als ersten Schritt in der SMaRT-Fuhrparkanalyse mit Ihnen gemeinsam ein Projektziel. Die SMaRT-Analyse ist ein Teil der Arval Mobility Fuhrparkberatung. Die 5-Stufen-Strategie umfasst die Bewertung des Ist-Zustands sowie die Planung und die Umsetzung alternativer Mobilitätslösungen. Mit uns implementieren Sie Schritt für Schritt Ihre Nachhaltigkeitsziele im Fuhrpark und Fuhrparkmanagement. Was sind Ihre Nachhaltigkeitsambitionen? Wie sieht Ihr Fuhrpark der Zukunft aus? Wir bringen Sie Ihrem Ziel näher.

2. Verstehen des Status Quo: Was sind die bestehenden Mobilitätslösungen und welche neuen Anforderungen gibt es an den Fuhrpark?

Danach werden alle relevanten Daten erhoben und analysiert – vom Fahrzeugbestand, den gefahrenen Kilometern über die Unfallstatistiken bis hin zum Kraftstoffverbrauch. Mit gezielten Fragen erörtern wir alle wichtigen Aspekte, die das nachhaltige Fuhrparkmanagement und die Effizienz Ihrer Flotte beeinflussen.

3. Ihren Fuhrpark optimieren: Wir setzen geeignete Lösungen im Fuhrpark um.

Es geht an die Umsetzung: Auf Basis der Ergebnisse der Fuhrparkanalyse definieren wir die nächsten Schritte mit Berücksichtigung der Bedürfnisse Ihrer Fahrenden.

Fleet Review – die weiterführende Fuhrparkbetreuung

Jedes Jahr erstellt Ihr persönlicher Fuhrparkberatender einen detaillierten Fleet Review zu Ihrer Flotte mit allen relevanten Daten und Analysen, beispielsweise der Schadensanalyse oder Verbrauchszahlen. Der Review beschreibt die aktuelle Situation in Ihrem Fuhrpark und gibt Einblicke in die Entwicklungen der vergangenen zwölf Monate.

Die Ergebnisse des Review bieten die Grundlage für weitere Verbesserungen in Ihrem Fuhrpark. Sie dient nicht nur als Rückblick, sondern auch als Grundlage strategischer Schritte im Flottenmanagement.

Im Mittelpunkt stehen insbesondere die Schadensanalyse, Kostenfaktoren, der TCO oder Verbrauchskennzahlen. Wir entwickeln auf Basis des Fleet Reviews Ihren Fuhrpark kontinuierlich weiter. Wir definieren gemeinsam mit Ihnen messbare Ziele, um die Effizienz Ihrer Flotte zu erhöhen.

Warum ist eine ausführliche Fuhrparkanalyse sinnvoll?

-

Wir ermitteln versteckte Ausgaben dank der detaillierten Analyse aller Kostenfaktoren

-

Durch die Fuhrparkanalyse können Routen optimiert werden und die Fahrzeugauslastung verbessert sich

-

Die passende Kraftstoffauswahl erhöht die Flotteneffizienz

-

Sie definieren Ihre Mobilitätsbedürfnisse gemeinsam mit einem persönlichen Fuhrparkberater und finden den passenden Antrieb für Ihre Flottenfahrzeuge

Was macht die Fuhrparkberatung bei Arval so besonders?

Wir legen großen Wert auf individuelle Kundenbetreuung. Daher steht Ihnen von Anfang an ein persönlicher Kundenberater zur Seite. Dieser tauscht sich jederzeit mit seinen Kollegen vom Account-Team aus. Unsere Spezialisten unterstützen Sie gemeinsam bei der Analyse und der Optimierung Ihres Fuhrparks.

Unsere Consultants greifen nicht nur auf ihren eigenen Erfahrungsschatz im Bereich Flottenmanagement zurück, sondern auch auf das Wissen eines großen Experten-Netzwerks: Von Versicherern über zertifizierte Kfz-Werkstätten bis hin zu Wallbox-Anbietern für integrative Ladelösungen – Arval kooperiert mit Spezialisten aus allen Bereichen rund um das Thema Mobilität und alternative Antriebe.

Infos zur Gestaltung Ihrer Car Policy

Climate Fresk- Projekte für einen grünen Fußabdruck

Der Ansatz

Arval unterstützt Kunden bei der CO2-Reduzierung der Fahrzeugflotte durch ein umfassendes, zertifiziertes Kohlenstoffkompensationsprogramm, um die Fahrzeugflotte in eine Klimaschutzmaßnahme zu verwandeln.

Arval vervollständigt mit diesem Baustein das Angebot, Kunden auf dem Weg zur CO2-Neutralität zu begleiten und denjenigen, die bereits an einem Projekt zur Schadstoffreduzierung auf Unternehmens- oder Flottenebene beteiligt sind, gezielte und klimabezogene Projekte zur Reduzierung der CO2-Emissionen anzubieten.

So funktioniert's

1. Definition der nachhaltigen Ambitionen und Messung des CO2-Abdruckes

2. Unterstützung bei rechtlichen Themen und Onboarding

3. Auswahl eines zertifizierten Kompensationsprojektes

4. Verwandeln Sie den Fuhrpark Ihres Unternehmens in eine Klima-Aktion

Warum Arval?

Vertrauen Sie uns

Die Kraft eines globalen Partners mit über 30 Jahren Leasingerfahrung

Gemeinsam mit uns

Wir helfen Ihnen die beste Lösung für Ihre Bedürfnisse zu finden

Verlassen Sie sich auf uns

Wir sind da, wenn Sie uns brauchen - persönlich oder digital

Einfach fahren

Sie fahren und wir kümmern uns um die anderen Dinge